Growing inequality is, according to President Barack Obama, “the defining issue of our time.” In the week following his re-election, the president has vowed not to abandon his resolve to raise taxes on those earning over $250,000.

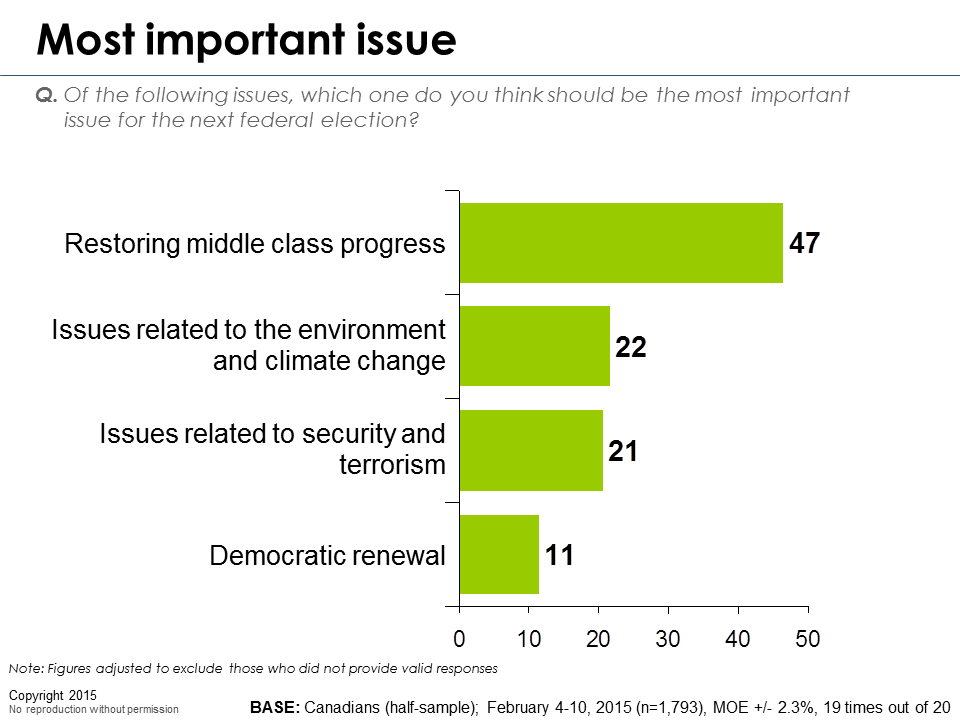

This fascinates me. What is it that has propelled the issue of inequality to these dizzying heights? Which straw broke which camel’s back? And why do other, arguably more critical, issues such as climate change and our energy future seemingly fail to ignite the imagination of the public and the president?

Much has been written about the causes and effects of inequality in the U.S. I am going to focus my attention on Canada, where a good deal of ink also has been spilt, often without clear reference to the underlying facts and forces.

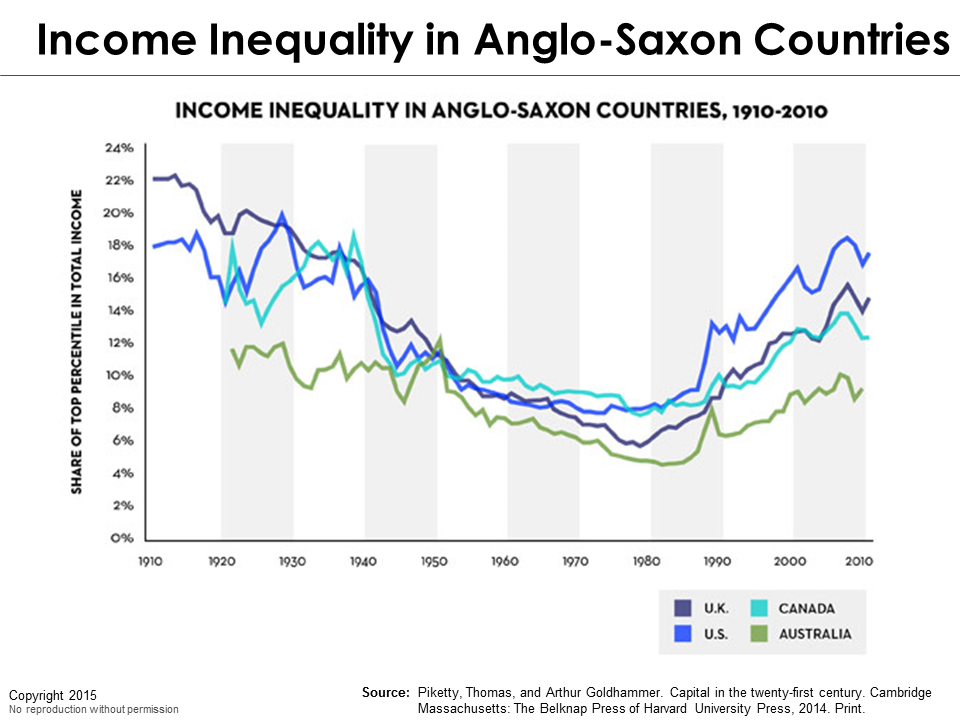

Globally, income inequality has never been higher. Certain countries are managing to keep it in check (Brazil, for example), but most middle- and high-income countries are more unequal now than they have been since at least the 1920s. This is certainly true of Canada, which sits near the middle of the OECD inequality rankings. But what do we learn if we dig a little deeper into the various measures of inequality?

The most common of these is the Gini coefficient, which measures the variance between actual income distribution and a theoretical, perfectly equal distribution. Thus, a Gini of zero tells us that there is no deviation and that everyone is perfectly equal. A Gini of 1 means that one individual has all the income, everyone else has nothing: winner takes all, writ large. Three categories of Gini are typically employed: the market income Gini, the total income Gini and the Gini after taxes and transfers (the ‘outcome Gini’ as I like to think of it: this overlays first-cut distributions with societal choices about taxation and supports).

To simplify, let’s take look at the market income and outcome Ginis for the past three decades. Between 1981 and 2010 the market Gini in Canada went up 19 per cent from .434 to .518. Over the same period the outcome Gini went up only 13.5 per cent from .348 to .395. So, overall inequality in Canada has risen — quite a bit, in fact — but taxes and transfers have, over time, offset an increasing portion of this rise (though not enough to smooth the outcome Gini completely).

Now, let’s look at when the big jumps in overall inequality took place. Judging by the recent prominence of the topic, one would imagine that the last few years had been particularly inequitable, but this is not borne out by the data. Pretty much all the increase in the Gini coefficients took place in the 1980s and 1990s. For each measure, the increase between 2000 and 2010 was less than 1 per cent.

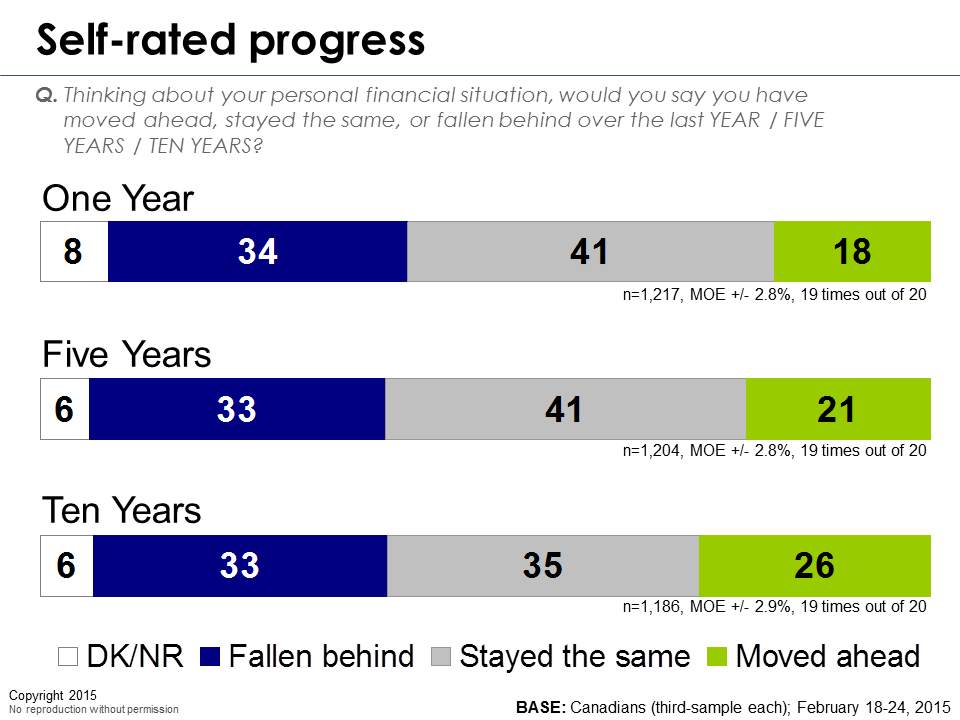

This is unexpected. Most of us certainly feel that the world is becoming more unequal (which, in the end, is what matters). So what’s going on?

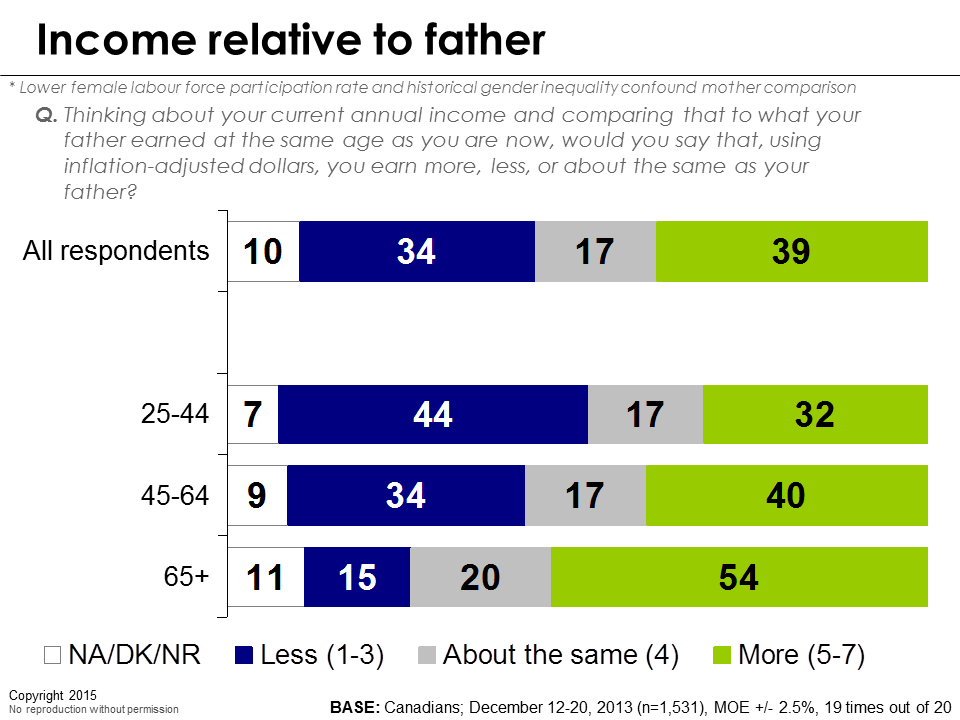

First, some groups have been doing much worse than others. Median family income rose by about 38 per cent between 2000 and 2010, but if you look at single-earner male couple families, there was no rise — in fact, there was a 1 per cent drop.

So burdens are not equally shared. There are those who have ample cause to complain, though I don’t know if they’re actually the ones doing the complaining.

The ones truly burdened by income inequality typically hail from the very bottom of the income spectrum, and this is where the limitations of the Gini coefficient come into play. Ginis are best at measuring changes in the middle, where most people are clustered. They are less good at capturing change at the very top and the very bottom of the distribution — the tails. In Canada this is where a good deal of the action takes place. Although we sit in the middle of the overall OECD inequality ranking, we are third in the OECD (after the U.S. and the U.K.) in terms of share of pre-tax income going to the top 1 per cent.

Second, there is a markedly higher sense of overall economic insecurity today than in the recent past. Unemployment in Canada peaked at 8.5 per cent in late 2009, having fallen to below 6 per cent a few years earlier (it is now 7.4 per cent). Youth unemployment, though, is significantly higher at 14.7 per cent. So younger people are hurting, especially as they contemplate making their way onto the property ladder. The cost of new housing has gone up by 55 per cent since 2000 — significantly outstripping the increase in median wages which, as you will recall, has been only 37 per cent.

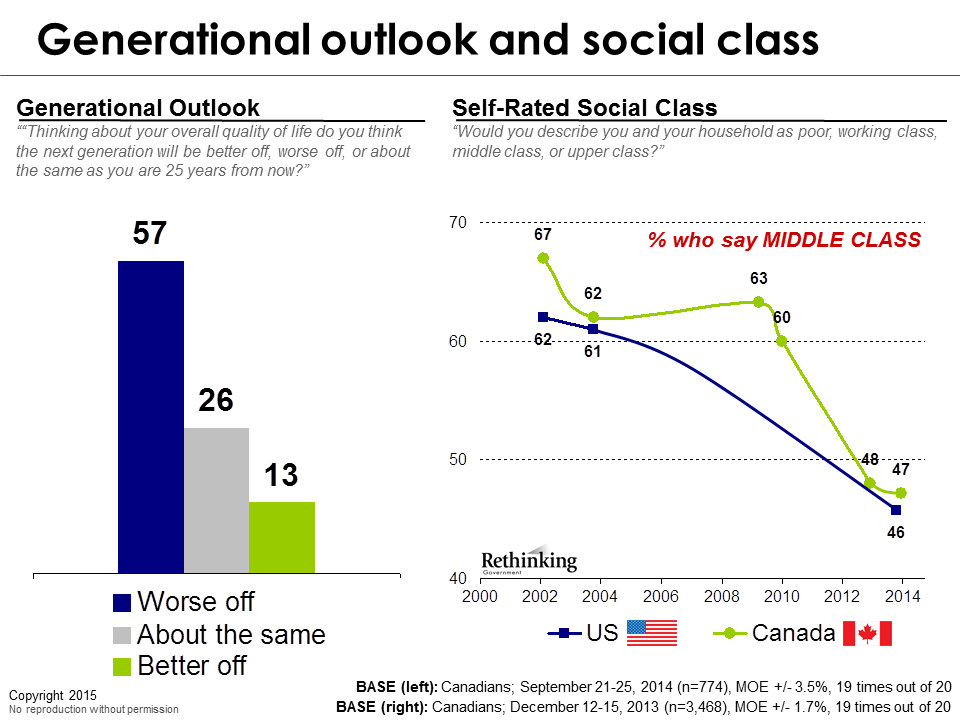

Third, we Canadians tend to see ourselves reflected in the experience of the U.S. — and things are a lot worse there. Especially during the election campaign we were inundated with tales of real woe from many of the formerly blue-collar regions of the United States.

By contrast, readers might be surprised to discover that the real hourly wages of Canadians in full time employment actually grew by 14 per cent between 1981 and 2011. Even more surprising is that fully 10 per cent of that 14 per cent growth took place between 1998 and 2011. Another interesting marker here is that all of the jobs lost in the recession in Canada have, according to the Bank of Canada, now been replaced. Ninety percent of the new jobs are in industries paying above average wages.

Again, though, not everyone had the same experience. Between 1981 to 2011 average (real) hourly wages increased by 17 per cent for men aged 45-54 but only 1 per cent for men aged 25-34 (youth gets nailed again). Another surprising fact is that, having risen sharply in the 1980s and the 1990s, the wage gap between those with bachelor’s degrees and those with high school diplomas or trade certificates has actually fallen since 2000. It is likely that this modest degree of wage convergence is attributable to Canada’s energy and resources boom: demand for skilled trades is at an all-time high, just as our tech sector — which employs more highly educated people — has contracted. Nonetheless, the “education gap” in income between those with post-secondary and those without remains significant: in 2011 it was about 37 per cent for men but a shocking 55 per cent for women.

Reflecting on these data points brings me to conclude that it may not be in the top-line numbers that the real story of inequality lies, at least in Canada. We have to dig a little deeper. I see three root causes of our concern with inequality in Canada (three seems to be the magic number).

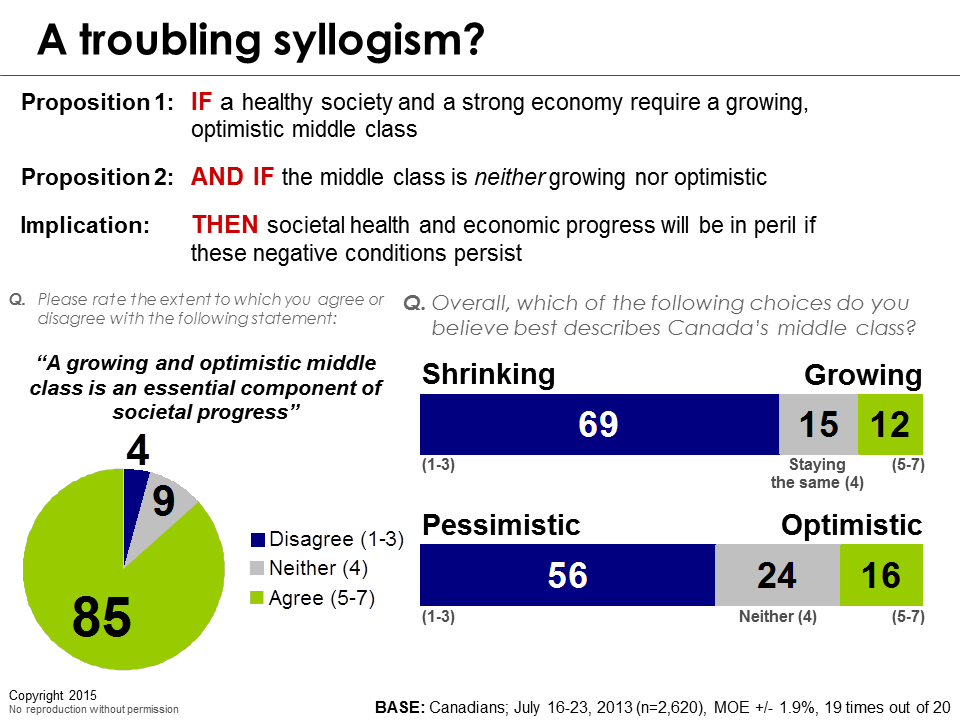

First, there is a general lack of confidence in our economic future, as a country and as individuals. In March 2012, polling by Ekos found that 57 per cent of Canadians felt that they would be worse off in 25 years than they are today. This is a staggeringly large number of people in a country that has been an outlier (on the positive side) in terms of economic mobility — the decoupling of one’s own prospects from those of one’s parents.

Related to this is a lack of vision for the future at a political level. Even our supposed destiny as an energy superpower seems hard to grasp and if we fail in that regard it is not clear what the back-up plan is. Without an alternative vision, it is reasonable to expect that trends around income consolidation at the top of the spectrum will continue, to the detriment of the majority.

Second, the politics of division are coming home to roost. The grass is always greener on the other side and the Occupy movement has provided a voice to many unhappy people. The visibility and excess of the top 0.1 per cent — the group that has been almost solely responsible for shifts in Canada’s overall inequality rate since 2000 — play a part. (The share of income going to the top 0.1 per cent increased from 2 per cent in 1980 to 5.3 per cent immediately pre-recession in 2007: the share going to the top 1 per cent is up from about 7 per cent to 10 per cent over a similar period.) So does the bursting of the credit bubble that previously masked some of the inequality. Another big factor in Canada is regional inequality, but there is no space to go into details about that here.

Third, I perceive a fear that the institutions that underpin our country and the global system are either threatened, rotten or inadequate to face down the challenges of the future. The global financial system comes first to mind, but with so many recent scandals in the worlds of politics and business it’s no wonder people are nervous. In Canada this disquiet extends to our education and health systems, both of which have been key to our high levels of economic mobility and both of which face myriad challenges.

How, then, should we address these three root causes? It seems to me that the common thread between them is their relationship to equality of opportunity. People feel that this is slipping from their grasp. The good news — as esteemed economist and recent Canada 2020 guest Larry Summers suggested recently — is that this may be a policy area around which progressives and conservatives can come together. Bolstering this may end up being the single most important thing that we can do for our economies in the near future.

The promotion — using a wide array of policy tools — of equality of opportunity should help not only to encourage entrepreneurism and boost productivity (which we badly need) but also to remedy the dangerous social fragmentation that goes hand-in-hand with a perception of deepening inequality. If you are in any doubt about the nature of such fragmentation, I strongly advise reading the book The Spirit Level, which correlates almost every societal ill with inequality, and the lack of hope and aspiration that such a condition engenders.

So, let’s embrace inequality as the defining issue of our time and confront it head-on by promoting greater opportunities for all. Then, my hope is that the climate agenda – which I perceive as far more intractable – will steal the spotlight and forcefully demand serious policy action.