Month: November 2014

Photo & Video: Global Commission on Internet Governance

Photo: Minister John Baird, Carl Bildt, Evan Solomon & more

Video: Minister John Baird & Carl Bildt

Video: Panel discussion, with Evan Solomon, Carl Bildt, Latha Reddy, Moez Chakchouk, and Melissa Hathaway

Photo & Video: Mikhail Kasyanov, former Russian Prime Minister

Photo: In Conversation with former Russian Prime Minister Mikhail Kasyanov

Video: Mikhail Kasyanov & Chrystia Freeland

Video: Audience Q&A

The case for a carbon tax in Canada

1. Introduction

Climate change is widely recognized as the preeminent environmental threat facing the world’s current and future generations. A recent report by the International Energy Agency suggests that with current climate policies, global mean temperature is likely to increase by between 3.6 and 5.3 ◦C, with most of that increase occurring this century. This is far outside the temperature range experienced in the history of humanity.1

A temperature increase of this magnitude would cause significant hardship, in the form of rising sea levels, reduced freshwater and food availability, increased disease spread, reduced biodiversity, increased conflict, reduced productivity, and other factors.2 The highly-cited Review of climate change economics by Nicholas Stern estimates that the costs of unchecked climate change could be as much as 20 percent of gross world product.3

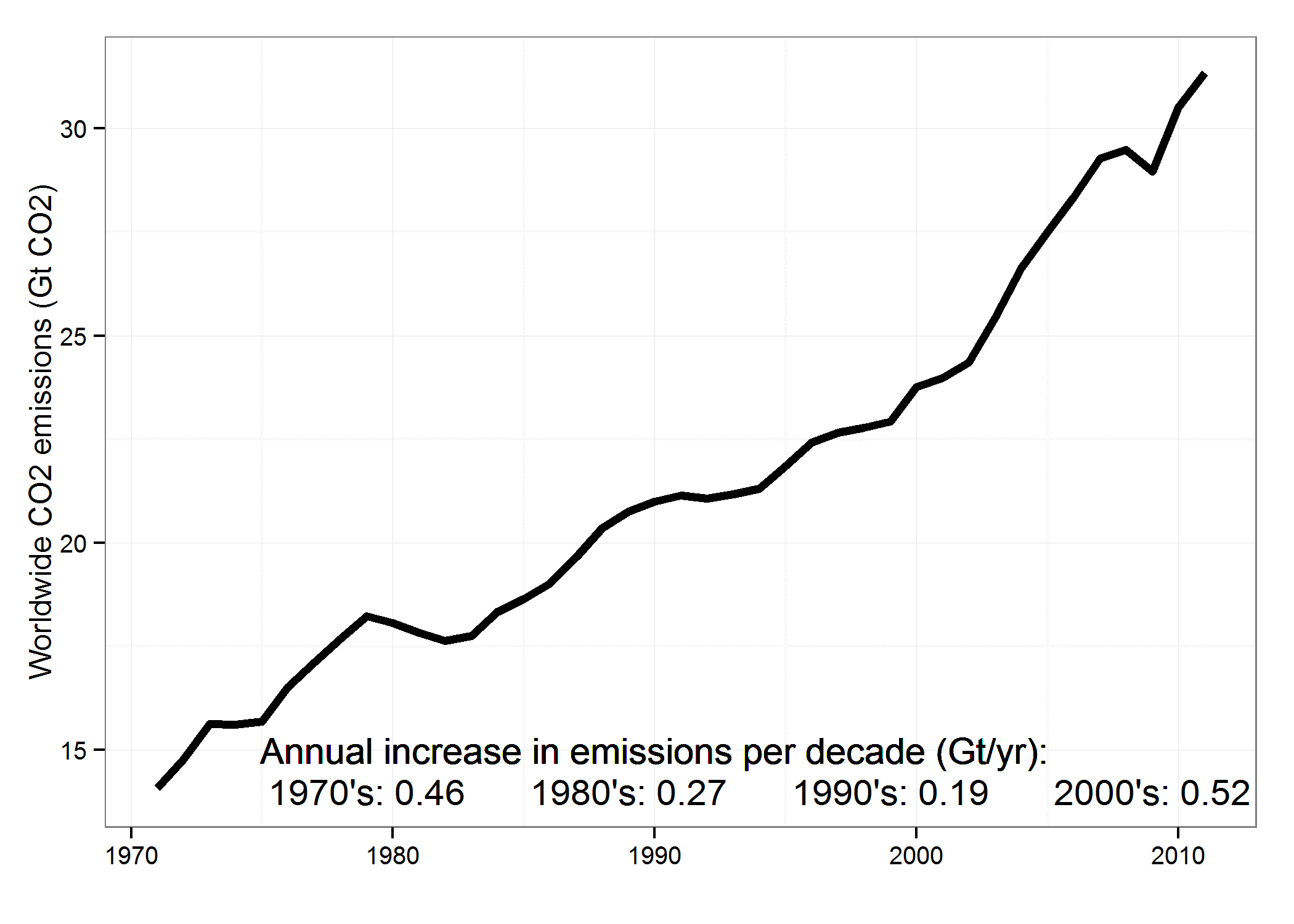

Globally, annual emissions of carbon dioxide, the primary greenhouse gas, reached 32 billion tonnes (gigatonnes, or Gt) in 2012, their highest level ever. In fact, during the last decade worldwide annual emissions growth was higher than at any time in the past, as Figure 1 illustrates. As a consequence, in May of 2013, the atmospheric concentration of carbon dioxide eclipsed 400 parts per million – its highest level in at least several hundred thousand years.

It has been estimated that to avoid “dangerous anthropogenic interference with the climate system” – generally defined as a global mean surface temperature increase of more than 2 ◦C relative to pre-industrial levels – the atmospheric carbon dioxide concentration should be stabilized at no higher than 450 parts per million. Calculations by climate modellers suggest that meeting this target will be extremely challenging. In order to have a relatively high probability of not exceeding the 2 ◦C “dangerous” threshold, the Intergovernmental Panel on Climate Change estimates that total cumulative emissions from CO2 should not exceed 2900 Gt.4 Through 2011, humans have emitted about 1890 Gt CO2, leaving about 1000 Gt CO2 as a remaining worldwide carbon budget. Comparing this to Figure 1 helps to illustrate the scope of the climate mitigation challenge. At today’s emission levels, the carbon budget will be exhausted in approximately 30 years. To maintain within the 450 ppm limit, emissions would need to fall to zero (or even to negative values) after that point. Even achieving less ambitious climate targets, such as seeking to limit temperature change to 3 ◦C with just 50 percent probability, require significant reductions in carbon emissions both in the near and long term.5 Given that annual emissions are currently growing, the scale of the challenge is evident.

So far, the world has not effectively responded to this challenge. Because of the global nature of climate change, most countries have been reluctant to undertake significant effort to reduce emissions without a guarantee that others will do the same, perceiving that the majority of benefits from such an effort will accrue to other countries. The sentiment is expressed recently by Canada’s Environment Minister at a climate change conference in New York, where she stated: “we want a fair agreement that includes all emitters and all economies. It’s not up to one country to solve [global climate change].”6 The resulting stalemate hurts all countries, and is unlikely to change without a new approach.

There is, however, some recent optimism around an (old) approach that turns the historic approach to climate change negotiations on its head: rather than waiting for a worldwide agreement before undertaking significant emission reductions at home, an alternative approach would use domestic climate policies as a springboard for coordinating international action. Under such an approach, some countries would unilaterally implement modest but meaningful climate change mitigation policies. These policy statements would include escalators – promises to increase the ambition of the policy under the condition that other countries also undertake meaningful policies to reduce emissions.7 Such an approach would focus on the actions which government is directly able to control – its policies – and de-emphasize commitments focused on the level of emissions, over which government has less direct control.8 Additionally an approach beginning with unconditional unilateral emission reductions could help to foster increased trust in international climate negotiations, and could encourage other countries to follow suit. If escalation clauses were built into domestic climate policies, the result could be a gradual tightening of global emissions constraints. Such a bottom-up approach may help to ease the deadlock in international climate negotiations.

Indeed, this bottom-up type of approach already complements the formal negotiations over emission reduction targets and timelines that occur through the United Nations. The European Union, for example, has implemented an emission trading system as well as renewable energy targets, and conditions the stringency of its domestic emission reduction targets on action by other countries. The United States, Canada, and other countries have also taken modest steps to reduce emissions. As a result of recently-implemented policies, it appears that the US is on pace for meeting its 2020 emission reduction target. However, Canada is increasingly falling behind other countries in the ambition and scope of its climate policies, and appears almost certain to miss (by a significant margin) its 2020 emission reduction target. Limited action on climate change in Canada helps to provide a foil for other countries seeking to delay or weaken domestic emission reduction efforts.

Canada has repeatedly affirmed its commitment to avoiding dangerous climate change during its participation at conferences to the United Nations Framework Convention on Climate Change. However Canadian domestic action has so far fallen significantly short of international promises, such that Canada has failed to achieve its prior commitments, including at the World Conference on the Changing Climate and the Kyoto Protocol. Its recent commitment, made at the Copenhagen United Nations conference in 2010, is likewise incompatible with current policies and emission trends.9

Canada produced around 700 Mt of greenhouse gas emissions in 2012. Although Canadian emissions have fallen slightly since 2005 – due especially to phase-out of coal fired power plants in Ontario – the long-term trajectory of emissions in Canada is upwards. Emissions have increased by about 15 percent since 1990, and a recent government forecast suggests that emissions are likely to increase through at least 2020 under current climate policies.10

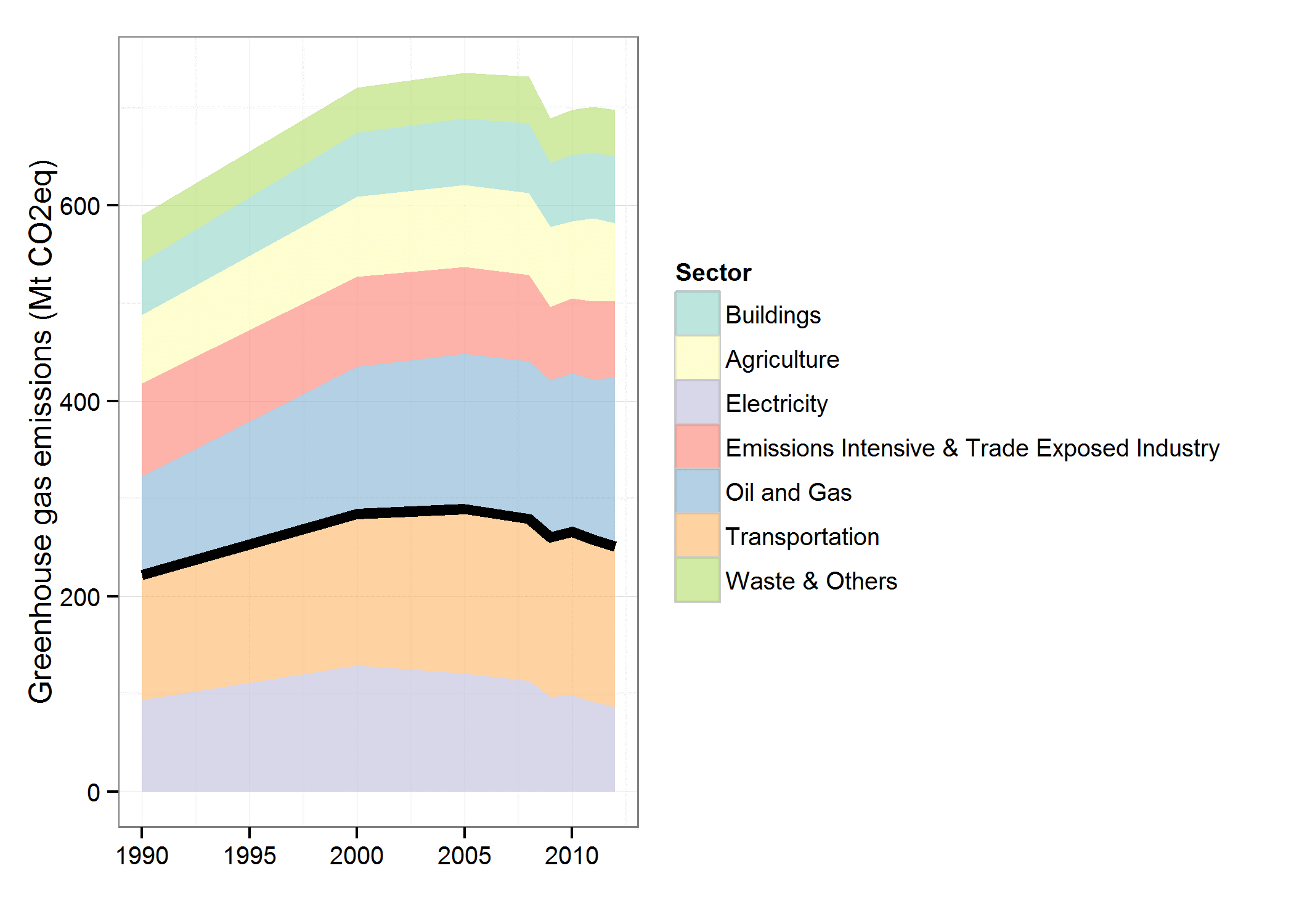

The increase in emissions in Canada and the consequent failure to meet international commitments reflects the absence of strong policies to curb greenhouse gases. At the federal level, climate change policy essentially consists of four regulations, governing the greenhouse gas intensity of the new light duty and heavy duty vehicle fleets, the greenhouse gas intensity of new coal-fired power plants, and the renewable fuel content in gasoline and diesel. In each case, these regulations are more costly than necessary, and the total amount of greenhouse gases that will be reduced by the policies is small, especially in the near- to mid-term. Most importantly, the limited set of policies covers only a small amount of emissions in the economy, allowing emissions in the remainder of the economy to increase unabated (see Figure 2).

This paper suggests an alternative approach to domestic greenhouse gas policy is required. I begin by outlining a set of key objectives that should confront any effort to develop a domestic greenhouse gas policy. I then contrast these objectives with current Canadian climate change policies, and show how a new approach is required. Finally, I articulate a policy that can meet federal climate change objectives. The policy I favour – an emission pricing policy such as a carbon tax – is not novel; environmental taxes have been economists’ recommended policy approach for solving environmental problems for close to a century and carbon pricing has recently been promoted by a wide range of stakeholders as a necessary policy to address climate change. My aim is to articulate the possibility for a carbon tax to efficiently and effectively contribute to significantly reducing greenhouse gas emissions in Canada. I explain the particular strengths associated with carbon taxes relative to the existing regulatory approach for reducing emissions, and provide evidence to show that implementation of such a policy could reduce emissions at very low cost to the economy. Indeed, relative to the current approach for reducing emissions, a carbon tax would be associated with significant cost savings. Adopting such a policy could achieve Canada’s domestic greenhouse gas targets, help to salvage our international reputation as a responsible environmental steward, encourage global mitigation of emissions, and help to reduce costs associated with reducing emissions. Clearly implementing a meaningful carbon tax is a political challenge, but the potential rewards to such an approach are large.

2. Goals to structure approach to climate change

Reducing greenhouse gas emissions has proven to be one of the thorniest public policy problems the world has faced; William Nordhaus refers to it as “the granddaddy of public goods problems.”11 Difficulties arise in particular because of the long-term and global nature of the problem, as well as the lack of a simple and low-cost technological fix. For public policy makers, this means designing a policy that minimizes costs imposed on current generations since benefits accrue mostly to future generations, that recognizes the global context for reducing greenhouse gas emissions, and that recognizes that an approach focused on particular technologies will be insufficient. In Canada, policy makers face the additional challenge associated with navigating issues associated with division of powers and distribution of costs and benefits across the federation. Given these constraints, an effective policy should aim to satisfy a number of goals.

2.1 Encourage mitigation by the rest of the world

Canada produces just 2 percent of the world’s emissions.12 As a result, even substantial reduction of emissions in Canada will have a trivial impact on the atmospheric concentration of carbon dioxide and other greenhouse gases, which are the result of cumulative emissions over time by all countries. Meaningful mitigation of climate change can be achieved only through the combined efforts of all major emitters.

Yet cooperative global action on climate change has so far proven extremely elusive. Since the costs of reducing greenhouse gases are borne by the individual country taking action, while the benefits accrue to all countries, climate change mitigation has all the features of the famous ‘prisoner’s dilemma’: it is in each country’s interest to free-ride off the efforts of others, such that none take serious action. Countries, in other words, avoid cooperating. And just as the two prisoners end up with more jail time than they would each prefer as a result of their failure to cooperate, in the absence of cooperation all countries end up with more climate change than they would each prefer.

In the case of climate change, it is hard to see a way around this fundamental difficulty of the problem. International environmental agreements (IEAs), which have productively been employed to address other transboundary environmental problems, have so far not encouraged significant effort.13 The lack of success from IEAs like the Kyoto Protocol and the Copenhagen Agreement results from the lack of central authority to compel states to reduce emissions. Without a central authority forcing each state to limit its emissions (as occurs in the case of domestic environmental policy), each state can defect from the treaty or participate but agree to only trivial cuts in emissions. A recent review summarizes IEAs as follows: “Overall, the thrust of the IEA literature is that cooperation, even in simplified settings where countries are viewed as individual, rational actors, is difficult and achievable only under specific conditions.”14 Economic theory and real world practice suggest that this pessimistic result holds especially in the case of climate change, where the costs of reducing emissions are non-trivial.15

Yet some hope can perhaps be derived from other similar public goods problems, albeit on a much smaller scale. Elinor Ostrom received the 2009 Nobel Prize in Economics for her work in examining the emergence of self-government institutions in similar prisoners dilemma-type environments.16 For example, she carefully documents a number of small-scale community fisheries that – lacking outside government or defined property rights – were over-exploiting their fishery and experiencing significant hardship as a result. She shows how in some cases these communities were able to develop institutions to effectively govern the fishery – even in the absence of a centralized institution. Drawing from a large body of evidence, she writes: “The prediction that resource users are led inevitably to destroy [the environment] is based on a model that assumes all individuals are selfish, norm-free, and maximizers of short-run results. . . However, predictions based on this model are not supported in field research or laboratory experiments . . . ”17 In particular, there is evidence that reciprocal cooperation can be established if the proportion of participants that act in a narrow, self-interested manner is not too high.18

There are a number of challenges associated with scaling up from the examples of community- scale resource management that are central in Ostrom’s work, but it seems reasonable to suggest that if countries do act as narrowly self-interested norm-free maximizers of short-run results, little cooperation will emerge on climate change mitigation. Conversely, if a country takes a concrete step to reduce emissions, at least some other countries will likely be a little more willing to reduce emissions. Unilateral action by a country may help contribute to increased trust and action by other countries, and as a result create additional benefit for the original country. In the same vein, inaction on the part of a country is likely to undermine trust and limit the willingness of other countries to pursue mitigation efforts. Global action on climate change is likely to begin with domestic action, not the other way around.

It needs to be said that there is little evidence on the global level that supports this assertion – it could be that other countries will continue to pursue narrow self-interested strategies even if one or several countries take a lead in reducing emissions. There are two rebuttals. First, if pursued efficiently the cost of modest but meaningful unilateral action on climate change is low, as I will document later in the paper. Canada can afford to, and has a moral obligation to, take a step to reduce emissions. Second, if all countries do continue to behave in a narrow, self-interested manner, we can be virtually sure that the climate change problem will remain intractable. Solving the climate change problem requires some countries to act first. As a high-emitting wealthy country, Canada has the moral obligation and the capacity to be one of those countries.

Importantly, since one of the major goals of domestic action should be encouraging other countries to increase the level of their effort, one of the key features of domestic policies should be the ability to clearly communicate to other countries the concrete steps that a country is taking to reduce emissions. Complicated policies, which contain a large number of provisions and technology-specific mandates, are not straightforward for other countries to understand, and will likely do little to foster reciprocity by other countries. In contrast, simple policies that clearly communicate the level of emission abatement effort are more likely to communicate policy ambition to other countries, and potential encourage reciprocity.

2.2. Contribute a fair share to global emission reductions and set goals commensurately with domestic policies

In addition to encouraging other countries to reduce their emissions, Canada’s greenhouse gas reduction effort should be commensurate with its global ambitions for climate change mitigation. Canada has repeatedly affirmed its commitment to avoiding “dangerous” climate change, which – as described previously – requires dramatically reducing global emissions today through mid-century. Determining how to allocate the global emission reduction effort across emitting countries is not scientific, but is instead the domain of ethics and economics. A large literature describes alternative philosophical principles for sharing a joint burden, and has informed different proposals for sharing the worldwide greenhouse gas abatement challenge between countries.19 Potentially important factors for determining an appropriate division of effort between countries include the relative contribution to historic emissions, the relative population, the relative capacity to reduce emissions, and the relative cost of reducing emissions. As a high-emitting wealthy country, Canadian action on climate change should be greater than the worldwide average, suggesting a moral imperative for aggressive Canadian climate action.20

Of course, Canada should not and will not naively implement the aggressive policies consistent with achieving a 2 ◦C target, since this would ignore the global nature of the climate change problem, where benefits of policy implementation accrue mostly to other countries. Instead, Canada should implement a modest but meaningful emission reduction policy that shows its willingness to productively engage on reducing emissions. It should accompany this policy with a promise to significantly increase the stringency of domestic emission reductions given other countries also undertake similar efforts to reduce emissions. Such an approach helps to both minimize the cost of action as well as promote global engagement on reducing emissions.

Importantly, Canadian domestic policy on greenhouse gas reductions should be commensurate with its international stance on emission reductions. It undermines the international consensus for a country to call for stringent action abroad while implementing weak policies at home. Like- wise, it reduces the goodwill and trust of other countries when internationally-promised emission reduction targets are repeatedly jettisoned. Coordination of domestic and international positions would improve Canada’s moral standing on climate change. A sensible manner for this coordination to take place is for implementation (or planning) of emission reduction policies to precede the establishment of emission reduction targets. Governments have direct control over policy implementation, but generally have substantially less control over total emissions in a country. International commitments should be made over the elements over which governments have control.

2.3 Reduce emissions cost effectively

Reducing greenhouse gas emissions need not be expensive. The recent report from the Intergovernmental Panel on Climate Change, which summarizes evidence on mitigation of greenhouse gas emissions, suggests that the deep greenhouse gas reductions required throughout the 21st century to limit warming to 2 ◦C would cost around 2 percent of global world product over the course of the century.21 Although deep greenhouse gas mitigation is required for stabilizing climate change, the modest reductions in emissions that would comprise a first meaningful step can be extremely low cost. For example, Canadian studies suggest that reducing emissions by 20 percent is likely to cost less than one percent of GDP. If these emission reductions were achieved over the course of a decade, they might cause a reduction in the growth rate of GDP by less than one tenth of a percent per year. Additionally, there are likely to be co-benefits to reducing greenhouse gas emissions, such as improved air quality, which have the potential to render action on climate change cheaper and potentially cost-free, even when undertaken unilaterally.22

There is also scope for substantially reducing the cost of climate policy through effective policy instrument choice and design. If reductions in carbon emissions are pursued through a revenue- neutral tax swap, as I will describe later, then the net cost of climate policy can be significantly reduced. Some studies suggest that with a tax-shifting approach, the net costs of modest climate policy might even be negative.23

Prior experience with carbon policies in other jurisdictions suggests similarly that reducing greenhouse gas emissions can be done without significant economic cost. For example, a recent analysis of British Columbia’s carbon tax suggests that no discernible impact on aggregate economic output can be attributed to the carbon tax.24 Macroeconometric modelling of the European carbon taxes suggests similarly that the effects on aggregate economic output of modest carbon taxes are small.25

However, while reducing emissions need not be expensive, it can be expensive, if policies are not designed efficiently. And just as we know what makes reducing greenhouse gas emissions relatively cheap, we have a good idea of what makes reducing emissions relatively expensive. Expensive policies are likely to be those that (1) provide different incentives for reducing emissions to different sectors of the economy, or even for emission reductions within a sector, (2) overlap with existing policies in a way that aggravates costs, (3) pick technological winners. These elements are precisely what characterize the current Canadian approach to reducing greenhouse gas emissions. The current “sector by sector regulatory approach” uses different targets for different sectors, and leaves a substantial portion of the economy with no incentive at all to reduce emissions, favours incumbents over new entrants, features policies that overlap, and sometimes directly contradict one another, at federal and provincial levels, picks technological winners, and generally adopts features that likely significantly aggravate costs compared to a more efficient approach. While the excess costs for such an approach are not easily apparent when the stringency of policies is limited, the use of inefficient policies essentially prohibits the pursuit of deep greenhouse gas reductions, for which a cost-effective approach is required.

2.4 Avoid inter-governmental conflicts

Canada’s constitution is silent on environmental protection. As a result, constitutional authority over environmental protection is divided between federal and provincial governments through other provisions in the constitution. The resulting division of powers renders the environment “an abstruse matter which does not comfortably fit within the existing division of power without considerable overlap and uncertainty”, according to former supreme court Justice La Forest.26

Partly as a result of the ambiguous status of environmental protection in the constitution, past efforts to reduce greenhouse gases in Canada have resulted in conflict between the two levels of government. For example, prior to the signature of the Kyoto Protocol in 1997, the Canadian federal and provincial governments negotiated extensively regarding the appropriate target for national greenhouse gas reductions. When the federal government committed internationally to a more stringent target than it had agreed to with provincial counterparts, federal-provincial discussions on climate change became strained.27 More recently, divisions have emerged between emissions-intensive Alberta and Saskatchewan and relatively low-emissions provinces such as Quebec and British Columbia. Indeed, determining how to allocate the emission reduction effort across provinces in the federation may be as important to securing an acceptable climate policy in Canada as the overall target.28

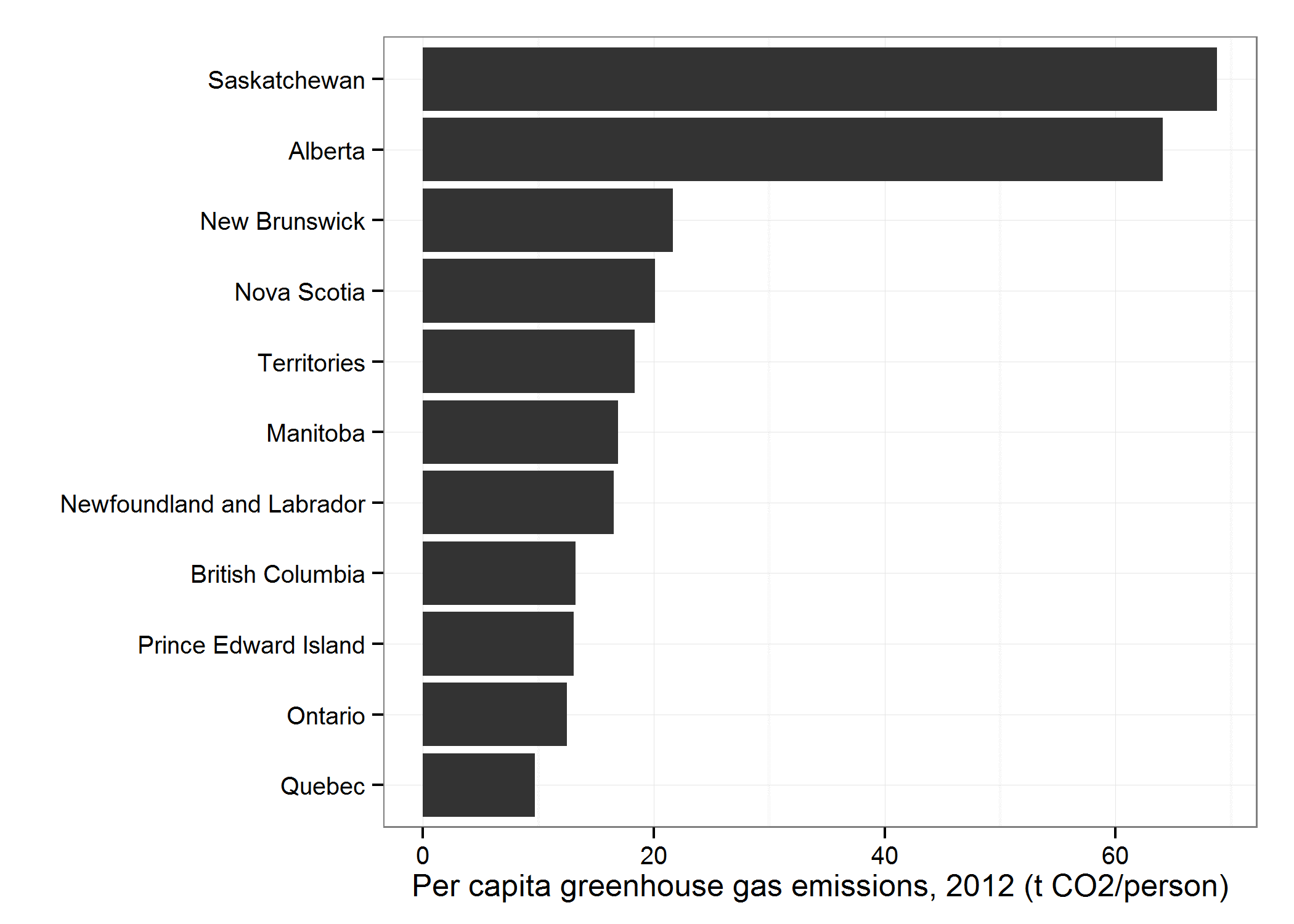

Given this reality, any federal-led greenhouse gas mitigation policy in Canada needs to place a high importance on maintaining cohesion within the federation. Policies that place one or some provinces at a perceived disadvantage relative to others are likely to face stiff opposition. Potential for such disadvantage is high as a result of the uneven distribution of greenhouse gas emissions within the country. As shown in Figure 3, per capita emissions in Alberta and Saskatchewan are roughly seven times as high as in Quebec and Ontario. Unless it is modified somehow, a traditional carbon pricing policy risks imposing high costs in Alberta and Saskatchewan relative to these other provinces, and as a result will likely be impossible to implement.29 A successful federally-led climate change policy will need to effectively address federal-provincial issues to be relatively palatable to all provinces.

3. Current approach to climate change is inconsistent with criteria

At the federal level, the government’s current approach to climate change is based on a sector-by- sector regulatory approach, under which regulations have been implemented to address emissions from coal-fired electricity generating plants, and heavy- and light-duty vehicles.30 In each case, the main purpose of the regulation is to reduce the greenhouse gas intensity of new the capital stock. In addition to these regulations, government has implemented regulations requiring the blending of renewable fuels in diesel and gasoline, and it maintains a number of modest financial incentive programs aimed at improving energy efficiency.31

It hardly needs to be said that Canada’s current approach to climate change mitigation is lacking, as the limits of the policy approach have been the subject of significant media attention. Here, I briefly outline the key shortfalls. First, the level of ambition embodied in Canada’s policies is inconsistent with stated commitments to reducing greenhouse gases. The key federal climate regulations are estimated (by the federal government) to reduce emissions by around 27 Mt by 2020.32 This compares poorly to the 250 Mt gap between a no-measures counterfactual and Canada’s current 2020 emission reduction target.33, 34

Second, the cost effectiveness of existing policies is poor. A cost effective policy should seek out the cheapest sources for reducing emissions throughout the economy. By contrast, the existing federal policy focuses on just a small subset of the economy, leaving a large majority without regulation, even though costs of achieving reductions in this uncovered portion of the economy may be low. Even within regulated sectors, the regulations seek emission reductions from some measures, but not others. For example, purchasing a more fuel efficient vehicle helps to meet the Light Duty vehicle regulation, but driving an existing vehicle less intensively does not, even though both actions contribute to emission reductions. Likewise, regulations govern the operation of coal-fired power plants, while natural gas-fired power plants are free to emit greenhouse gases. The regulations additionally focus only on emissions from new capital stock, leaving the existing capital stock free to produce greenhouse gases. All of these features worsen the cost effectiveness of the sector-by-sector regulatory approach. Cost effectiveness is also hampered by policy overlap. In a number of cases, there are overlapping regulations at federal and provincial levels, which can aggravate costs. As an example, both provinces and the federal government require blending of biofuels in gasoline and diesel (with differing amounts between federal and provincial governments), and neither level of government recognizes the other’s policy for compliance purposes.

A number of other more subtle disadvantages are also associated with the sector-by-sector regulatory approach. One important one is that they are complicated, with their design requiring specialized knowledge of the trends and technologies available in the regulated sector. Their complexity leaves government bureaucrats at an informational disadvantage relative to industry insiders, who can play a large role in shaping the regulations. This likely helps explain the structure of the regulations, which leave incumbent firms relatively unregulated and focus effort on reducing emissions from future capital stock (e.g., in the case of coal-fired power plants). Their complexity also means that they are opaque to the average Canadian, which hampers a meaningful engagement on climate change policy. Finally, their complexity means that it is difficult for other countries to easily measure the strength of Canada’s domestic greenhouse gas mitigation agenda.

These features of the policies are directly related to policy design. Sector-specific regulations by their nature only cover emissions from a subset of the economy (a sector). Designing sector regulations to cover a substantial portion of the economy takes significant time; recent regulations have taken multiple years to develop and implement and regulations governing oil and gas emissions were first proposed 8 years ago. Different regulations in different sectors implies different stringencies in different sectors which increases costs of compliance.

Just as the federal approach to climate change is wanting domestically, so it is internationally. Canada is widely viewed as an impediment to the securing of a more robust international agreement on mitigating emissions. The international environmental community has been especially critical of Canada’s international positions, awarding it with five “fossil of the year” awards to single it out as the largest impediment to environmental action. Particular critique was focused on Canada’s abrupt withdrawal from the Kyoto Protocol, immediately following the conclusion of a large meeting in Durban where diplomats were working on shaping an international agreement for reducing emissions in years following 2012. Canada’s confrontational approach on climate change is also evident in an open letter written by the Prime Minister to his Australian counterpart in 2014, congratulating him on eliminating his country’s carbon tax. In general, the flippant nature with which Canada regards its international commitments to reduce greenhouse gases – it appears to most observers that Canada’s Copenhagen commitment to reduce emissions by 17 percent from 2005 levels by 2020 will not be met – undermines the international process aimed at securing collaborative emission reductions between countries.

Overall, the existing approach to tackling climate change is significantly disconnected from the goals I suggest should guide climate policy. The limited ambition, poor coverage, and lack of transparency associated with the sector-by-sector regulatory approach causes Canada to be perceived as a laggard on climate change, and helps to provide license for other countries to follow suit. The approach also significantly exacerbates domestic costs of achieving emissions reductions. On the international front, Canada has made commitments with no plan to meet them, snubbed the established international process, and encouraged other countries to reduce the ambition of their own climate policies. Rather than promoting worldwide effort to reduce emissions, Canada’s actions – both at home and abroad – have undermined it.

4. A rising carbon tax can achieve objectives efficiently

Adoption of an economy-wide carbon tax, at a modest but meaningful level, is much better aligned with Canada’s climate change goals than the existing sector-by-sector approach. Through such an approach, Canada could cost-effectively reduce emissions as well as signal to other countries its commitment to reduce emissions. In this section, I articulate the particular strengths of the carbon tax approach to reducing emissions and international engagement.

While I single out the carbon tax as the optimal policy for reducing emissions, there are a number of close similarities between a carbon tax and other policies that put a uniform price on carbon emitted from different sources in the economy. In particular, cap and trade policies have been implemented in a number of jurisdictions to reduce emissions of greenhouse gases, including California, Europe, and Quebec. Likewise, so-called “benchmark-and-credit” systems have been used to reduce greenhouse gas emissions in Alberta. While each of these systems offer different advantages and disadvantages, these are of second-order importance in comparison to the difference between any of these emission pricing systems and the current sector-by-sector regulations that form the core of Canada’s current emission reduction strategy. Indeed, when actually implemented, the various emission pricing systems can be designed to be very similar to one another. For example, the price level of a carbon tax can be adjusted over time, just as a cap and trade system can be implemented with price collars on the trading price, such that the difference in practice between various emission pricing policies is at least in part semantic. As a result, in this article, I focus on the implementation of a domestic carbon tax, but note that many of the same advantages could result from appropriate design of other emission pricing policies – most notably an economy-wide cap and trade system.35

4.1 Why carbon taxes

Amongst policy analysts, international organizations, many large companies, and academics, there is a nearly universal acknowledgment that a carbon tax represents the optimal policy instrument for reducing greenhouse gases. For example, a recent International Monetary Fund report suggests that countries should implement energy taxes that reflect environmental externalities,36 and a recent World Bank initiative aims to encourage countries around the world to adopt carbon pricing to stimulate greenhouse gas reductions.37 The highly-respected bipartisan US Congressional Budget Office claims that “a tax on emissions would be the most efficient incentive-based option for reducing emissions and could be relatively easy to implement.”38 Major corporations also support a carbon tax; for example, a recent statement by major institutional investors, together managing $24 trillion in assets, calls for “stable and economically meaningful carbon pricing.”39 In a similar vein, a recent survey of top US economists found near unanimity on the optimality of a carbon tax as an instrument for reducing greenhouse gas emissions.40 This high degree of consensus is also echoed in the academic literature, which affirms the significant economic efficiency benefit of market-based emissions reduction programs such as a carbon tax.41

There are a number of reasons for the near-universal support of a carbon tax (or other emission pricing policy) amongst economists and other policy analysts, amongst the most important of which are:

4.1.1 Carbon taxes are cost effective

The primary asset of a carbon tax (which is shared with other market based instruments, such as cap and trade) is that it minimizes the cost of reducing emissions.42 Since sources of emissions are heterogeneous, attempts to control emissions using a technology or performance standard cause some sources to be forced to undertake relatively costly abatement activities, and leaves other sources relatively under-regulated or un-regulated altogether. The advantage of a carbon tax is that it provides the same incentive to all firms and households to reduce emissions, resulting in an optimal allocation of emission reductions across the economy. The cost savings that result from this optimal allocation of emission reductions can be significant. Costs for a market based instrument are estimated to be half of a comparable technology standard that controls emissions of nitrogen oxides from power plants in the US.43 In a variety of other contexts, Tietenberg finds costs of market based policies are 40 to 95 percent lower than conventional regulatory instruments.44

4.1.2 Carbon taxes raise revenue that can be used for productive purposes

A defining feature of carbon taxes, compared to other policy instruments aimed at reducing pollution, is that they raise revenue. This revenue can be used for a number of purposes, but economists have focused in particular on the potential for carbon tax revenue to be used in a revenue-neutral tax swap.45 In this arrangement, carbon tax revenue funds a reduction in other taxes in the economy, such as taxes on personal or corporate income, or payroll taxes. Since these other taxes also impose costs on the economy, reducing their rates can offset some or all of the costs of a carbon tax, rendering emission reductions cost-free or nearly so at an economy wide level. Sometimes the approach is neatly summarized as: “tax bads [i.e., pollution], not goods [i.e., jobs, investment],” or more graphically: “tax what you burn, not what you earn.”

4.1.3 Carbon taxes can drive innovation

For deep greenhouse gas mitigation over the long term, it is important to consider how and whether emission reduction policies stimulate innovations in low carbon technology, which offers the potential to dramatically reduce the cost of achieving reductions in emissions. Because carbon taxes raise the cost of emitting carbon, they can direct both the rate and direction of technological change, as suggested by Hicks nearly a century ago: “a change in the relative prices of the factors of production is itself a spur to invention, and to invention of a particular kind – directed to economizing the use of a factor which has become relatively expensive.” More recent studies have confirmed Hicks’ induced innovation hypothesis, showing that high energy prices cause innovations in energy efficient technologies.46 Theoretical work suggests that carbon taxes are likely the most effective policy instrument at government’s disposal for spurring technological change.47

4.1.4 Carbon taxes are transparent and simple to design

Legislation to support a carbon tax could be short and simple. In a recent interview, Henry Jacoby, an economist at MIT, says that carbon tax legislation could fit on a single page.48 Actually implemented carbon tax legislation runs somewhat longer than a page,49 but both in theory and in practice a carbon tax is extremely straightforward to design: fuels are taxed in proportion to carbon content. The necessary tax infrastructure is already in place, since fuels are already subject to other taxes. In contrast, other types of policies to reduce emissions are much more complex. Canada’s regulations on passenger and heavy duty vehicles are long and difficult to under- stand, and the (failed) US cap and trade bill of 2009 famously was well over 1,000 pages long. The simplicity of a carbon tax makes it easy to understand, both for individuals within the country – which facilitates engagement and understanding – and for other countries – which makes it straightforward to explain the stringency of policy being pursued to other countries. British Columbia is widely considered a leader on climate change primarily as a result of implementing a carbon tax, even though other policies it has implemented may contribute as much or more to recent emission reductions.50

4.1.5 Carbon taxes minimize information requirements

A carbon tax is a market based instrument, meaning that it creates incentives for market participants to reduce emissions. When firms and individuals face a cost for reducing emissions, they can make informed choices to reduce emissions that are both in their own best interests and collectively achieve reductions in emissions. Government’s role is limited to setting an appropriate price for emissions, and monitoring and enforcing the policy. In contrast, with conventional environmental policy instruments, government’s role is much broader, and typically involves choosing particular emissions targets or technology requirements that are differentiated by sector, as well as selecting particular promising green technologies to promote. As such, conventional policy instruments require significant information on the part of government, which it likely does not possess (what emission reductions are possible in the oil and gas sector at low cost? Are electric vehicles ready for widespread adoption? How much can the efficiency of natural gas power plants be increased?).

4.2 Myths associated with a carbon tax

Despite the obvious academic appeal of a carbon tax, there is certainly limited political appetite for implementation of such a policy. In part, this is a result of several myths which are commonly associated with carbon taxes. Here, I briefly identify and attempt to counter some of the more prominent of these.

4.2.1 Carbon taxes are regressive

A frequently articulated concern associated with carbon taxes is that they could be regressive, having a substantial impact on the disposable income of poor households compared to wealthy households. This concern is based on the relative expenditure shares of households across the income distribution, where households at the bottom of the income distribution spend a larger share on carbon-intensive products like gasoline, electricity, and natural gas compared to wealthy households.51, 52 A number of recent contributions to the literature, however, assert that carbon taxes can be progressive or only mildly regressive when differences in both household expenditure sources and income sources are accounted for.53 In a recent analysis, my colleagues and I find that the carbon tax in British Columbia is progressive across the income distribution even before taking into account the specific tax measures that accompanied introduction of the carbon tax that favour low income households.54 In any case, the revenues from a carbon tax are easily large enough to compensate lower income households enough to leave them at least as well off as prior to the tax.55

4.2.2 Carbon taxes are ineffective if other countries don’t do anything

The global nature of the climate change problem makes securing international action the central challenge to tackle for addressing the problem. However, an even more pernicious aspect of the global nature of climate change is the potential for unrestricted trade in goods to undermine the emission reductions undertaken by a country acting alone. The concern is this: if a country undertakes a policy to reduce emissions, it could increase the cost associated with producing emissions-intensive goods in that country, causing facilities to become uncompetitive compared to those operating in countries without comparable carbon-reduction policies. Unless trade is restricted, there is potential that emissions intensive goods production will simply relocate to the unregulated region, and that the increase in emissions in the foreign facility could offset the reductions in the domestic facility, leading to no net change in emissions. If the foreign factory is less efficient, there is even potential that a unilateral policy in a country could increase global emission levels. Fortunately, extensive empirical investigation provides little support for this narrative. A recent review of more than 50 studies suggests that emissions leakage associated with unilateral regulation is likely between only 10 and 25 percent of the emission reductions associated with the policy, even if no additional measures are taken to curb leakage.56

4.2.3 Carbon taxes kill jobs

Carbon taxes are often seen as a challenge to economic growth, and particular concern has been voiced by policymakers around the potentially negative impact of a carbon tax on employment. Indeed, when carbon taxes have been discussed in recent House of Commons debates, they are almost always referred to as “job-killing.” Yet, there is very little evidence that supports the idea that carbon taxes harm employment – in fact the available evidence suggests the opposite. A useful recent analysis is based on the UK’s Climate Change Levy (CCL), which is a tax on industrial fuel use that raises prices of energy by an average of about 15 percent.57 The study finds that the CCL reduced energy intensity in manufacturing plants by about 18 percent, but that there was no measurable effect on employment, total factor productivity, or plant exit. A similar study examines the impact of the European Union’s Emission Trading System on German manufacturing firms, and finds the policy reduced emissions intensity by about 20 percent but had no identifiable effect on employment, gross output, or exports.58 Preliminary evidence from British Columbia likewise suggests that overall employment in that province increased as a result of the carbon tax.59

4.2.4 Carbon taxes are unpopular

In Canada and the US, “tax” is often considered a four-letter word, such that it is politically toxic to consider increases in the rate of any tax. Some consider carbon taxes to be especially divisive, since they are highly salient and are aimed at tackling climate change, which is not a goal universally considered important. Indeed, one the political lessons drawn from Stephane Dion’s failed election campaign in 2008 seems to be that support for a carbon tax renders a candidate unelectable. Of course, anecdotal evidence is a poor basis for important decisions, and at any rate, points both ways: Gordon Campbell was re-elected in British Columbia following his introduction of a carbon tax.60 Polling results are perhaps more useful. The polling firm Environics has tracked stated support for carbon taxes in annual public opinion surveys since at least 2008, and finds that carbon taxes are supported by the strong majority of Canadians.61 Support is not limited to individuals either. Carbon taxes have been supported in a number of open letters from industry associations to government. For example, in 2010, the Canadian Council of Chief Executives wrote that “governments at all levels should commit to a national approach to GHG reductions and carbon pricing.” This sentiment is echoed by 13 out of 14 industry associations in Canada surveyed for a report by Sustainable Prosperity.62 A national carbon tax even receives strong support from major oil and gas companies in Canada, who see it – like others – as the most efficient solution to reducing greenhouse gas emissions.63 This isn’t to say that the politics of carbon taxation is uncontroversial, merely that support for such policies is stronger than commonly assumed.

4.2.5 Carbon taxes are ineffective at reducing emissions

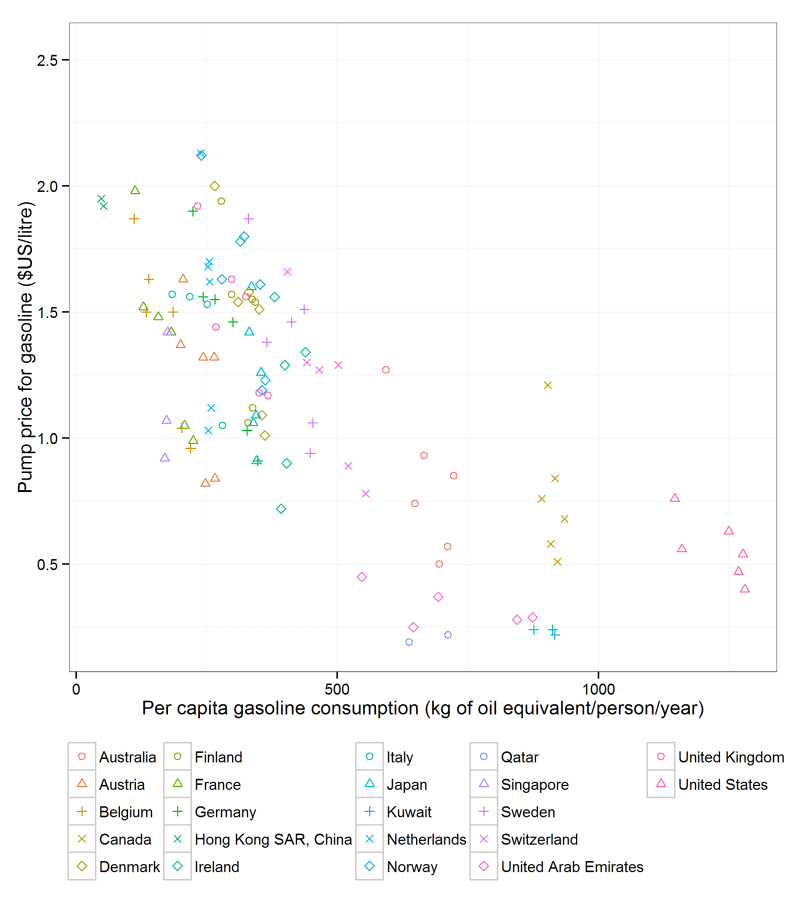

Discussion of carbon taxes eventually turns to their effects on emissions. One concern that is raised is that carbon taxes will have no effect on emissions. The concern is based on the notion that energy demand is inelastic – that is, demand does not change much in response to a price change. However, while it is true that energy demand is relatively price inelastic (especially in the short term), changes in price, such as due to a carbon tax, do affect consumption. For example, Figure 4 shows the relationship between per capita gasoline consumption and gasoline price in 22 large high income countries. There is a clear negative relationship between prices and gasoline consumption, both within a country and between countries. Evidence from British Columbia’s carbon tax likewise suggests a reduction in emissions attributable to the policy, with a reduction in emissions likely around 10 percent.64 Similar evidence is available from the UK Climate Change Levy (which reduced emissions intensity in manufacturing plants by about 18 percent)65 and from European carbon taxes,66 and the EU emission trading system.67

4.3 The design of a carbon tax

The basic design of an efficient carbon tax could be very simple, consisting of a uniform charge on coal, refined oil products, natural gas, and other fuels in proportion to the amount of carbon embodied in each fuel. The necessary tax infrastructure is already in place, since fuel retailers already collect and remit to government existing taxes on fuel. Such a tax would cover between 70 and 80 percent of total greenhouse gas emissions in the country (the remainder are not related to fuel combustion, and would need to be addressed with other policies or extensions to the carbon tax). The policy would provide all emitters with a uniform incentive to reduce emissions, resulting in a cost effective distribution of mitigation activities.

As with most types of government policy aimed at reducing emissions, the first-order concern for a domestic carbon tax relates to the stringency of the policy: how much will it reduce emissions?

In the case of a carbon tax, the stringency is measured as the level of the tax, with higher carbon taxes providing larger incentives to households and firms to reduce their emissions, as well as larger incentives for innovation of low-carbon products. It is likely that a carbon tax would have to be quite high to produce deep greenhouse gas reductions. For example, analysis for the National Roundtable on the Environment and Economy suggests that reducing greenhouse gas emissions by 70 percent by 2050 would require a carbon price between $200 and $350/t CO2.68 (For reference, each litre of gasoline produces about 2.4 kg of CO2, so a $200/t CO2 tax would increase gasoline prices by almost $0.50/L.) Similarly, the most recent Intergovernmental Panel on Climate Change report suggests a global carbon price increasing to around $200/t CO2 by mid-century would be required to have a high likelihood of avoiding dangerous climate change.69 At the same time, there are concerns that high carbon prices could damage the economy, particularly if they are imposed without adequate time for transition. Likewise, since the benefits from reducing greenhouse gas emissions are global, while the costs are local, it would be both poor strategy and poor politics to implement a highly aggressive carbon tax without some promises about equivalent action from other countries. Choosing the appropriate level of stringency requires balancing the desire for deep greenhouse gas reductions with concern relating to transitory and longer term disruptions to the economy, as well as with the aim of stimulating other countries to implement similar policies.

Given these concerns, one potential choice for the level of carbon tax would be the social cost of carbon (SCC) as calculated by Environment Canada and counterparts at the US Environmental Protection Agency.70 The SCC is a measure of the present and future damage associated with emissions of greenhouse gases. Although there are significant uncertainties associated with the calculation of the SCC, it reflects our best current understanding of the external costs associated with activities that generate greenhouse gas emissions. By setting a carbon tax at the level of the SCC, Canada could cost effectively internalize the external costs associated with its greenhouse gas emissions.71 The current best estimate for the social cost of carbon is about $40/t CO2, and this value increases over time in real terms to about double that value by mid-century (at a rate of about $1/t annually).72 Setting a carbon tax at this level would be efficient, supported by the best available evidence, and consistent with a “polluter pays” approach to environmental regulation. Importantly, it would be possible to signal to other countries our willingness to increase the stringency of domestic carbon tax conditional on reciprocal action by other countries. Adopting a modest carbon tax such as described would contain abatement costs to very manageable levels (see below), while conditionally promising a more ambitious domestic policy would leave open the possibility of more significant emissions reductions, such as would be required to reach the 2 ◦C goal to which Canada subscribes.

Canada’s key diplomatic failure on climate change has been to make extravagant international promises to reduce emissions, but then fail to implement policies commensurate with the commit- ments and as such to reach the promised levels of emissions. This divergence between promises and action has generated antipathy towards Canada, and reduced incentive for other countries to implement meaningful greenhouse gas mitigation policies of their own. By adopting a carbon tax set at the level of the social cost of carbon domestically, Canada would be able to estimate future levels of emissions to credibly commit to to help forge international collaboration of climate change. Importantly, in this model, the policies adopted at home would be used as inputs for setting inter- national goals, rather than the other way around. Internationally, adopting the carbon tax at the level of the SCC could also be an independent signal of Canada’s emission reductions. Increasingly there is pressure for the international climate change process to move away from its traditional focus on “targets and timetables” towards international coordination of emission reduction policies.73 For Canada, an international approach based on policy coordination rather than coordination of emission reduction obligations could be especially beneficial, since Canadian emissions are likely to increase faster than those in other developed countries absent GHG mitigation policies, especially as a result of faster population growth and structural change in the economy.

A key challenge associated with federal implementation of a carbon tax is its potentially heterogeneous impacts on the provinces. In particular, Alberta and Saskatchewan, with per capita emissions five to seven times as high as other provinces, are likely to resist implementation of a new federal government carbon tax, since they would pay a significantly larger amount per capita than other provinces.74 A federal carbon tax could be made more acceptable to all provinces if it was structured to permit equivalent carbon taxes in a province to override the federal tax. This type of equivalency agreement is relatively common in federal environmental policy making (in- deed, current federal regulations on coal fired power plants permit equivalency agreements). In this case, the federal government would set a national carbon tax at the level of the SCC, and agree to eliminate the tax in any province that implemented its own carbon tax at a level equal to or greater than the federal level. This approach would maintain the benefits associated with uniformly pricing carbon, and also be more acceptable to provinces than a federal carbon tax without equivalency provisions. Simulation suggest that under such an approach, the cost to provinces would be small and distributed relatively evenly across provinces.75

An important consideration associated with the implementation of a carbon tax concerns what to do with the revenues that are raised. A $40/t CO2 carbon tax would raise on the order of $25 billion per year. Since under an equalization scheme as described above, provinces would keep all carbon tax revenues, this decision would be made at the provincial level. A few options present themselves for provinces to disburse this additional revenue. One widely discussed option involves using carbon tax revenues to reduce pre-existing taxes elsewhere in the economy (for example, on personal or corporate income). Following this approach, the net burden of taxation is not increased at all, taxes are merely switched from one base (income) to another (pollution). Because of the revenue-neutral character of this tax-swap, most studies find minimal total economic costs (or even benefits) associated with a carbon tax swap.76 Another option is for government to earmark a portion of carbon tax revenue for investment in green technology, such as public transit or renewable energy. While the efficiency of this approach is likely worse than for a tax-swap, some polling results suggest that respondents are more likely to favour a carbon tax if a portion of the revenue is re-invested in green projects.77

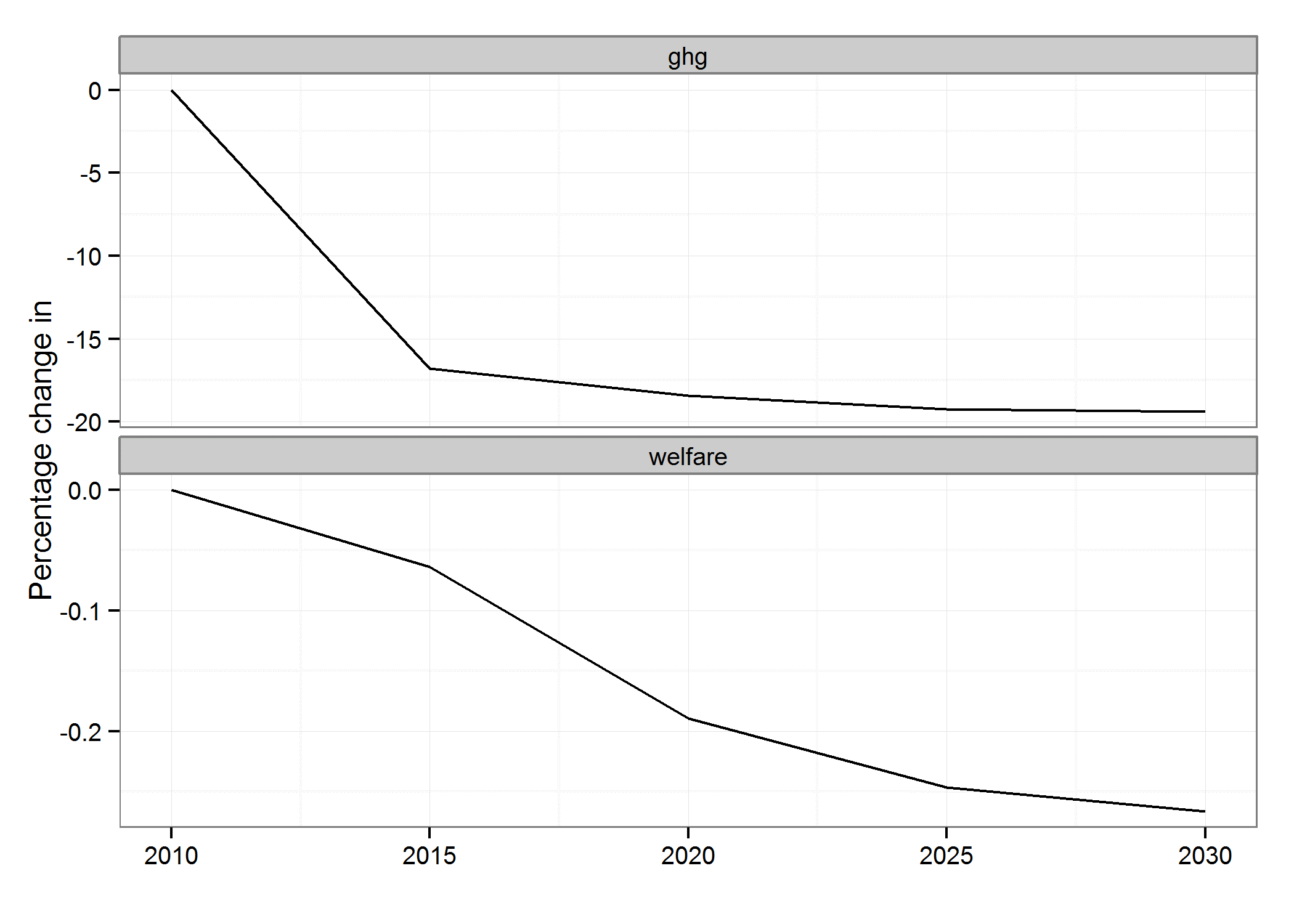

4.4 The effect of a carbon tax

A simulation model-based estimate of the domestic effect of a carbon tax as described above is given in Figure 5. In this analysis, a carbon tax of $40/t CO2 is adopted in 2015 and gradually increased by $1/t CO2 every year. The modest tax described here is estimated to reduce emissions by about 20 percent – roughly consistent with Canada’s current target for greenhouse gas reductions. The cost of reducing emissions is calculated at about 0.2 percent of income – for an average individual or household earning $50,000 per year, this works out to about $100 per year. (These costs are consistent with other estimates of the cost and effectiveness of carbon price policies.) Aggregate costs could be lower still if the revenue from the carbon tax was used to reduce other distortions in the economy, such as income or payroll taxes. Likewise, if co-benefits, especially from reduced air pollution, were taken into account, the cost of the policy would likely be lower than estimated here.

5. Conclusion

Obviously, there are clear political impediments to implementation of a carbon tax. However, just as obviously, the current sector-by-sector approach to reducing emissions is much less efficient than a carbon tax. For significant reductions in greenhouse gas emissions, the difference in the cost of these approaches could easily be in the billions or even tens of billions of dollars. In addition to domestic benefits, the adoption of a carbon tax could offer global benefits. First, it would help to improve Canada’s tarnished international reputation as a responsible environmental citizen. Second, it would advance global greenhouse gas reductions, especially if paired with an escalation clause.

This is the leadership challenge surrounding a carbon tax – convince voters to accept a green- house gas reduction policy that implements a price on greenhouse gas emissions, and collectively make Canadians better off by a significant margin.

About the Author

Nicholas Rivers earned his PhD in Resource and Environmental Management at Simon Fraser University in Vancouver, British Columbia. He holds a Master’s degree in Environmental Management and a Bachelor’s degree in Mechanical Engineering. His research focuses on the economic evaluation of environmental policies, and has been published in economics and energy journals as well as in other popular publications. Additionally, he is co-author of a recent book on climate change policy, Hot Air: Meeting Canada’s Climate Change Challenge. Mr. Rivers has worked for all levels of government, industry, and non-governmental organizations as a consultant on issues related to energy efficiency and climate change program evaluation, policy analysis and development, and economic modelling. He has received awards for his research from the Trudeau Foundation, the Social Science and Humanities Research Council, and the National Science and Engineering Research Council.

Photo: Canada 2020 Youth Town Hall with Max Valiquette & Anne Johnson

Canada 2020 welcomed two leading youth organizers – Max Valiquette and Anne Johnson – for a Town Hall style event at Nate’s in downtown Ottawa. Click below to view photos from the discussion: