A snapshot of Canada’s cannabis sector, one-year later

Executive Summary

Over the course of the final frantic days of the 2019 federal election campaign, more than 200 industry leaders, educators, and policy makers gathered to discuss Canada, Cannabis and the economy at Canada 2020’s Canadian Grown. The pace of development in this sector has been ground-breaking for Canada. Other jurisdictions around the world are now using Canada’s regulatory and economic framework as a model for their industries. Canada and the cannabis industry is disrupting more than policy circles around the G7 and the globe – Canada is creating new jobs, new supply chains and economic opportunity in this burgeoning economy at home. The one year anniversary of recreational cannabis is a good opportunity to review and reflect on what went well and where the opportunities lie. The second year in Canada promises to be just as exciting as the first – Phase II will witness the entry of edible products and other industry product innovations to the Canadian marketplace. Public perception of the industry is generally positive although consumers want to know more about products and economic contribution to the Canadian economy and their local economies.

Canada 2020 in partnership with Genome Canada, hosted Canadian Grown on the one year anniversary of the legalization of cannabis in Canada.

The anniversary afforded the opportunity to gather industry, educators and policy makers alike to the two day event in Toronto, ON. According to Statistics Canada and industry experts at Canadian Grown, it is estimated more than 5.9 million (or 16.7%) Canadians are regular users of recreational cannabis and more than 9,000 Canadians are now directly employed in the sector. This doesn’t include additional economic benefit numbers which trickle down (and up) from the sector. This one year old sector has contributed more than $8.2 billion to Gross Domestic Product (GDP) in 7 months in 2019.

There is still much work to do in many divergent policy areas. The retail rollout has not been uniform across Canada and this presents challenges of supply, customer access, marketing and advertising, growing capacity and taxation. There remain questions about the future of the medicinal sector and patient care issues. Research, development and intellectual property remain a key focus of industry players as well as recruitment and retention of highly skilled workers. The black market for illegal product and illegal selling activity is also a focus of government and industry.

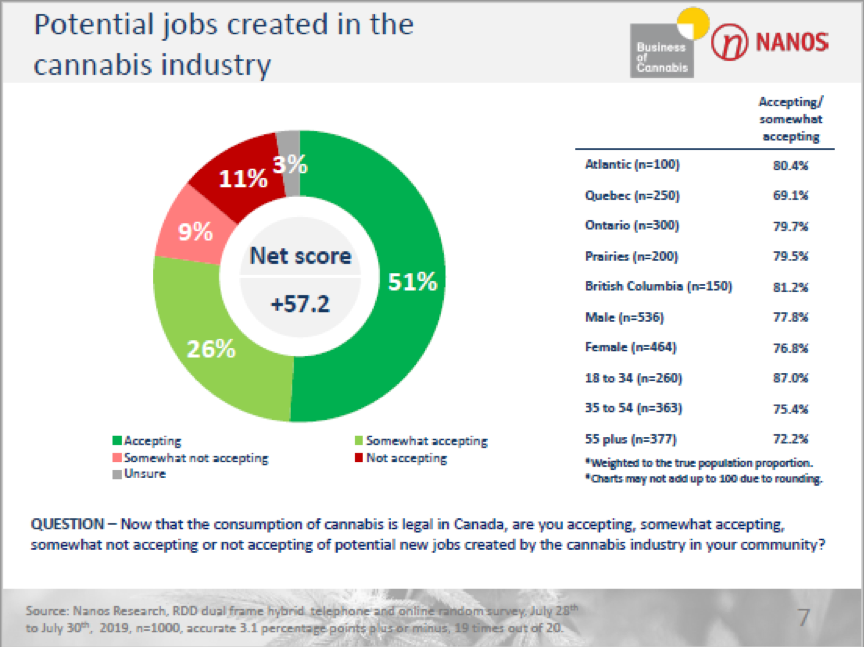

Overall, Canadians have a positive outlook on the some aspects of the industry in most regions of the country. More than 76% of Canadians surveyed by the Globe and Mail’s Report on Cannabis were either accepting or somewhat accepting of potential new jobs created by the industry in their home community. Canada 2020 was pleased to work with Genome Canada to produce this timely and informative industry event. Canada 2020 will be hosting a Policy Lab in the late fall of 2019 to continue the conversation started at this ground breaking event.

Prepared for Canada 2020 by Chris Smillie / Furthermore

Background

The path to recreational cannabis legalization in 2018 was fairly well worn by the medical cannabis regime with roots back to an Ontario Court of Appeal decision in 2000 and two decriminalization attempts in 2003 and 2004 in the House of Commons by successive Prime Ministers. An unscripted political decision made by the newly minted Leader of the Liberal Party Justin Trudeau made in a park in Kelowna, BC in the summer of 2013 ultimately did become the law of land October 17, 2018. Health Canada became the regulator and licensor for the recreational market as the policies, procedures and processes were already functional and sufficiently robust in the medical regime.

The Federal Task Force on Cannabis Legalization and Regulation was struck in mid-2016 by the Prime Minister with a mandate founded on two principles – public health and public safety. These principles were implemented with a view to the long term and did not take into account any functional regulatory thinking on marketing or advertising. The Task force consulted with industry, other jurisdictions and Canadians writ large over a 5 month period. After some consideration there was a conscious choice made to keep the medical and recreational markets separate at the outset of the process.

The Task Force did not address or forecast short or long term economic impact of the industry or take any economic considerations into account. The Task Force operated without the benefit of a breadth of academic research on much of the subject matter as in Canada cannabis was an illegal substance and the country lacked a breadth of clinical information on the substance. Similarly, even as elimination of the illegal market was part of the justification for legalization, the Task Force did not study this issue or make recommendations to stem growth.

The original mandate of the Task Force did not address issues of full amnesty; however the government did implement a pardon regime for Canadians with simple possession convictions with Bill C-93 in early 2019. According to some stakeholders like Cannabis Amnesty and some political leaders, Canada has a record of disproportionate and unfair prosecution and charges on certain populations. Advocacy work for expungement continues as the pardon regime may be inadequate for many Canadians who want to travel, sit on corporate boards as directors or volunteer with children’s organization. Recreational legalization means Canada is also afoul of some international treaties which makes conversations difficult across diplomatic channels but the industry views this as the cost of innovation and economic leadership.

Discussion Themes

This conference was attended by large Licenced Producers, industry experts/commentators, and some academia and public policy makers. The following are a series of themes and ideas presented at the conference.

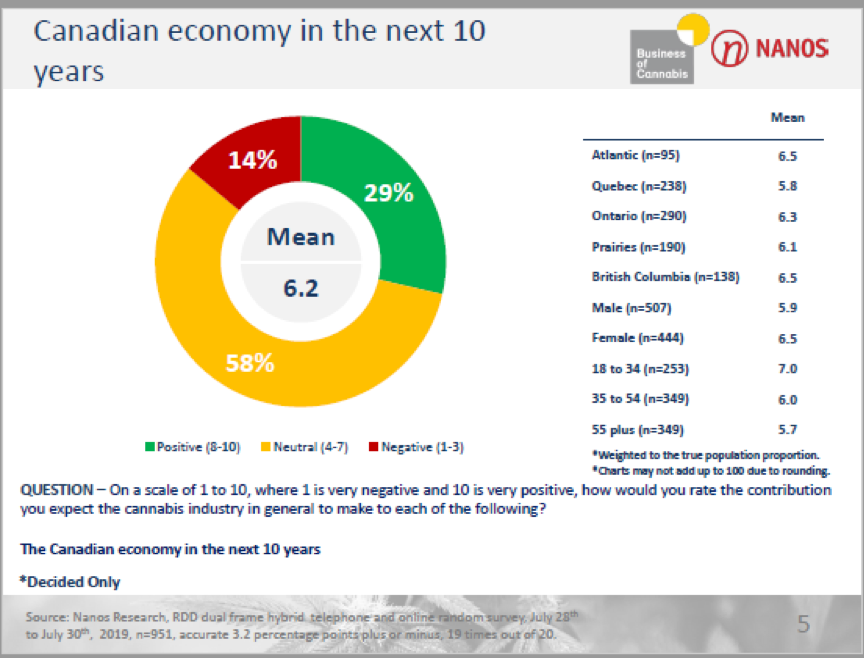

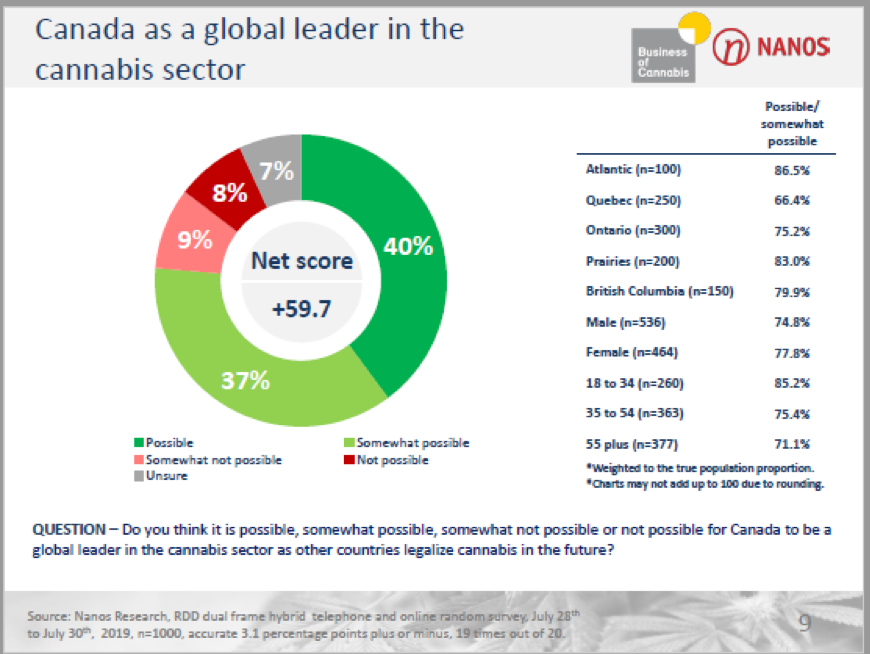

Public support, and Canada’s “first mover advantage”

According to data presented in the plenary session, the Canadian public is fairly supportive of legalization, the industry writ large, and potential local jobs associated with this industry. Overall, Canadians have a positive image of the industry and are open to local investment and related job opportunities at home. In addition, Canadians want their local governments to create the conditions for economic success in their local communities. Canadians are not clear on overall economic benefits the industry contributes but are open to learning more about this issue. From the data presented it was evident consumers could be interested in more information on Phase II products. Most regions are positive overall as to Canada’s status as a global leader in the cannabis sector.

Canada has a one year head start on building cannabis industrial infrastructure, raising investor capital and breaking ground in research in this sector. The investing climate is strong in the Canadian cannabis industry because of the first mover advantage. Cannabis investors around the world have flocked to Canada but it is forecasted this could change with more jurisdictions moving towards legalization and liberalization. In addition, the awakening of the US market is going to reshape the capital market landscape and have potential impact on the Canadian industry. Many American states have moved to legalize cannabis in both the recreational and medicinal markets Furthermore, if there is a Democratic administration elected in 2020 in the United States (with a more liberalized approach to cannabis) it could alter financial markets and capital flow globally in the industry.

“Phase II” could further complicate the situation as more finished cannabis products are being brought to market. These products have higher economic production value than Phase I products and thus the economic risk is greater if competing with product from the United States or elsewhere. Investment in manufacturing processes and partnerships with food and beverage companies have increased the stakes in Canada’s industry if first mover advantage is not captured in a reasonable timeframe. Health Canada is responsible for approving Phase II products and that process is underway. The move by the United States to remove “hemp” from the farm bill could be detrimental to the industry in Canada and create greater economic risk for all stakeholders.

Retail, and reaching consumers

Canada’s Cannabis retail landscape is not uniform. Each province has unique rules and regulations concerning consumption age and retail administration. In Ontario, Canada’s largest market by population, there are only two dozen retail outlets and one online retailer. In Alberta, by contrast, there are 65 retail outlets. There were three major threats facing the retail industry identified by various experts at the Canadian Grown event:

- Lack of access to product for consumers;

- Lack of product variety;

- “The Black Market”

In Ontario, municipalities held a vote to participate in or opt out of the retail system and permit potential cannabis retail outlets in their respective jurisdictions. The entire Ontario marketplace is served online by the Ontario Cannabis Store (OCS). Some participants had concerns about licencing and inspection being overly difficult for small industry participants.

Research and Development / Intellectual Property

Research and Development in the Cannabis sector is in its infancy. Given the complicated nature of Intellectual Property rights in the sector there is natural tension between public and private funding models for research and product development. Process patents for Phase II products will certainly be a growing challenge over the next number of years.

The industry is focused on models of data gathering, plant breeder rights and inherent challenges of dealing in a global IP marketplace. Some members of the audience championed a collaborative approach to patient tracking and IP collaboration. Others championed a model similar to the pharmaceutical industry.

There was consensus amongst some panelists that the challenges associated with the “drug” classification of CBD products were of concern and also Phase 1 products themselves. One LP indicated “regulatory fees” charged by Health Canada as a key irritant for medium and large size LPs and acted as a disincentive to increase product lines for consumers in the short to medium term.

The largest hurdle for the industry identified were filing and approval timelines with regulators for a new product. These act as disincentives for new product applications for consumers.

Some others listed in no particular order but discussed as barriers for R&D:

- Integrations with other industry players like food and beverage companies

- Intellectual Property issues across borders for products and processes

- Clinical trial delays and export of trials to other jurisdictions

- Crop changes and integration into agriculture /large scale outdoor growing

- Manufacturing process changes subject to new regulatory review

- Labour Market issues – attraction and retention of researchers and skilled workers

- Rule clarity around integration amongst educators, researchers and industry / product ethics like advertising and branding

- Edible “Phase II” rules

Patient Care, human health care, genomics and cannabinoids

Cannabis has the potential to play an important role in health care delivery in Canada however introducing a new class of medical treatment into any established system can be disruptive for patients and providers. In addition, the launch of the recreational market is most likely is skewing the true numbers of Canadians whom are seeking cannabis for a medical purpose. The most frequent self-reported reason for self-administration of cannabis are: sleep disturbances, chronic pain, and HIV.

Specialist referral rates are low from General Practitioners for cannabis related care as only a very small number of GPs are actively participating in referring patients to cannabinoid solutions. However, those that are referring patients are doing so very often. The Canadian Medical Association is urging a public health approach and increased reviews for efficacy, safety and quality on CBD products making a health claim.

Will the recreational marketplace displace the medical cannabis regime? The medical cannabis regime is currently in a five year review period. In four years the merits of the system will be examined and a determination will be made as to the viability of the medical system. This was a topic of concern for those on the panel and no consensus was reached. The provision of medical advice is a key element for the care and well -being of Canadians. Dosing issues and interaction(s) with other medications patients may consume at the same time as cannabis are of key concern to the medical and patient community.

Key Policy Questions

- Should Canada continue with the medical cannabis regime now that all consumers and patients have access through a retail network?

- How does the industry convince more medical professionals to prescribe cannabinoids for patients?

- What does black market enforcement look like? Who takes the lead? What is realistic?

- What should the future of the retail system look like?

- Is the licensing and enforcement regime functioning properly? Does it promote innovation?

- What kind of public awareness/alert campaign should accompany Phase II products?

- What should governments do with taxes and fees collected from the industry?

- Is taxing medical cannabis fair?

- Should veterinarians have access to the medical cannabis market for our pets?

- Should cannabis containing products which make a health claim be subject to a “drug like” review process?

- What is the ongoing role of medical practitioners and patient care processes for cannabinoids?

- How does Canada train, attract and retain the highest skilled workers for this sector?

- What does the future of advertising and marketing look like in this sector?

Next Steps

Canada 2020 is pleased to host a one day policy lab in the late fall of 2019. More details to follow.

References

Canada 2020, “Canadian Grown Conference proceedings and program”

Canadian Medical Association “Cannabis Fact Sheet”

Globe and Mail Report on Cannabis, “Nanos Research, RDD dual frame hybrid telephone and online random survey, July 28th to July 30th, 2019, n=1000, accurate 3.1 percentage points plus or minus, 19 times out of 20”

Government of Canada, “Federal Task Force on Cannabis Legalization and Regulation”

Statistics Canada, “Cannabis Stats Hub”